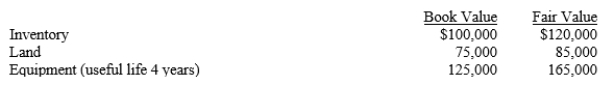

On January 1, 20X1, Promo, Inc. purchased 70% of Set Corporation for $469,000. On that date the book value of the net assets of Set totaled $500,000. Based on the appraisal done at the time of the purchase, all assets and liabilities had book values equal to their fair values except as follows:  The remaining excess of cost over book value was allocated to a patent with a 10-year useful life.

The remaining excess of cost over book value was allocated to a patent with a 10-year useful life.

During 20X1 Promo reported net income of $200,000 and Set had net income of $100,000.

What income from subsidiary did Promo include in its net income if Promo uses the simple equity method?

A) $33,000

B) $42,000

C) $70,000

D) $100,000

Correct Answer:

Verified

Q1: In a mid-year purchase when the subsidiary's

Q3: On January 1, 20X1, Promo, Inc. purchased

Q4: Balance sheet information for Pawn Company and

Q6: If in the consolidation process the investment

Q9: In consolidated financial statements, it is expected

Q11: On January 1, 20X1, Payne Corp. purchased

Q12: The method of accounting for subsidiaries that

Q13: Pete purchased 100% of the common stock

Q16: The method of accounting for subsidiaries where

Q19: The method of accounting for subsidiaries that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents