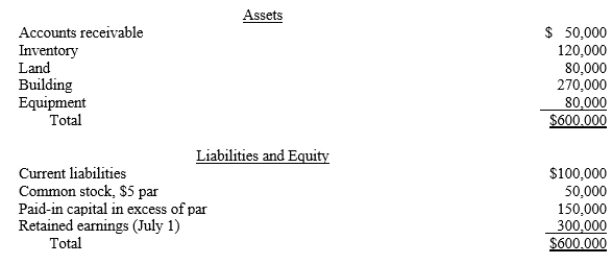

The Paris Company purchased an 80% interest in Seine, Inc. for $600,000 on July 1, 20X1, when Seine had the following balance sheet:

The inventory is understated by $20,000 and is sold in the third quarter of 20X1. The building has a fair value of $320,000 and a 10-year remaining life. The equipment has a fair value of $120,000 and a remaining life of 5 years. Any remaining excess is attributed to goodwill.

From July 1 through December 31, 20X1, Seine had net income of $100,000 and paid $10,000 in dividends.

Assume that Paris uses the cost method to record its investment in Seine.

Required:

a.Prepare a determination and distribution of excess schedule as of July 1, 20X1.

b.Prepare the eliminations and adjustments that would be made on the December 31, 20X1, consolidated worksheet to eliminate the investment in Seine. Distribute and amortize any excess.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: On January 1, 20X1, Parent Company purchased

Q25: Discuss the merits of accounting for subsidiaries

Q25: On January 1, 20X1, Parent Company purchased

Q27: On January 1, 20X1, Parent Company purchased

Q28: On January 1, 20X1, Parent Company purchased

Q29: Which of the following is not true

Q30: Refer to the information below and Worksheet

Q32: On January 1, 20X1, Parent Company purchased

Q34: Under IASB for small and medium entities,

Q34: The determination and distribution schedule for the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents