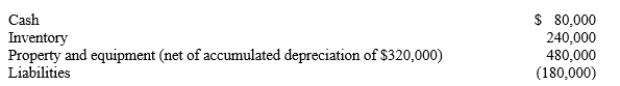

On April 1, 20X1, Paape Company paid $950,000 for all the issued and outstanding stock of Simon Corporation. The recorded assets and liabilities of the Simon Corporation on April 1, 20X1, follow:  On April 1, 20X1, it was determined that the inventory of Simon had a fair value of $190,000, and the property and equipment (net) had a fair value of $560,000. What is the amount of goodwill resulting from the business combination?

On April 1, 20X1, it was determined that the inventory of Simon had a fair value of $190,000, and the property and equipment (net) had a fair value of $560,000. What is the amount of goodwill resulting from the business combination?

A) $0

B) $120,000

C) $300,000

D) $230,000

Correct Answer:

Verified

Q1: An investor receives dividends from its investee

Q8: Which of the following is not true

Q14: Pinehollow acquired all of the outstanding stock

Q15: In an asset acquisition:

A)A consolidation must be

Q15: On April 1, 20X1, Paape Company paid

Q18: A subsidiary was acquired for cash in

Q19: An investor records its share of its

Q20: When it purchased Sutton, Inc. on January

Q21: Mans Company is about to purchase the

Q22: Supernova Company had the following summarized balance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents