General Lighting

During the first quarter of the current year, the company sold 4,000 batteries on credit for $150 each plus state sales tax of 6%.

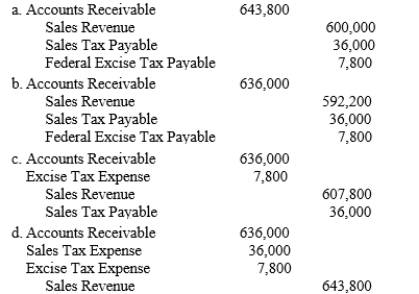

-Refer to General Lighting. The price of each battery includes a $1.95 federal excise tax. Any taxes collected must be paid to the appropriate governmental units at the end of the quarter. Which of the following is the proper journal entry to record for the sale of the batteries?

Correct Answer:

Verified

Q108: A company is required to estimate a

Q109: General Lighting

During the first quarter of the

Q110: A cookie company includes one premium coupon

Q111: Georgia's Salon

The salon sells $50,000 of gift

Q112: Which of the following would appear only

Q114: Georgia's Salon

The salon sells $50,000 of gift

Q115: General Lighting

During the first quarter of the

Q116: General Lighting

During the first quarter of the

Q117: German Auto Parts is a defendant in

Q118: On April 1, 2019, Guyton Sails accepted

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents