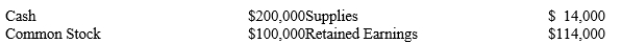

The accounting records of Cary's Magic Shows reflect the following account balances at January 1, 2019:  During 2019, the following transactions occurred:

During 2019, the following transactions occurred:

1.On February 1, rented a small office for a one year period of time. Paid $12,000 cash.

2.On November 1, received $3,600 cash for magic lessons to be provided evenly over November, December, and January.

3.By December 31, used 6,000 of the supplies.

4.At December 31, accrued $5,000 in wages and salaries.

5.During the year, paid cash for $25,000 in wages and salaries.

6.During the year, earned $65,000 cash in magic lesson revenue.

Required:

A)Determine the effect on financial statement accounts of the preceding transactions.

Hint: It may be helpful to create a table to reflect the increases and decreases in account.

B)Prepare an income statement for 2019 ignoring income taxes.

C)Prepare a classified balance sheet at December 31, 2019.

Correct Answer:

Verified

Q155: Q156: A photo processing store purchased office supplies Q157: A calendar year company paid $24,000 on Q158: What is the revenue recognition principle? Q159: Given below are the accounts from the Q162: Q163: Match the following types of adjusting entries Q164: Match the following types of adjusting entries Q165: Match the following types of adjusting entries Q199: For each transaction select the letter of![]()

You are the owner and operator of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents