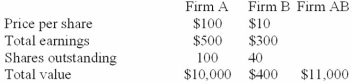

The following data on a merger is given:  Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. Calculate the post merger P/E ratio assuming cash is used in the acquisition.

Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. Calculate the post merger P/E ratio assuming cash is used in the acquisition.

A) 12.75

B) 6.25

C) 13.75

D) None of the above

Correct Answer:

Verified

Q12: The merger of Pfizer and Wyeth is

Q13: Companies A and B are valued as

Q14: Firm A has a value of $150

Q15: Firm A has a value of $100

Q16: Firm A has a value of $200

Q18: Live Nation acquisition of Ticketmaster is an

Q19: Roche acquisition of Genentech is an example

Q20: The following are good reasons for mergers:

I.

Q21: Firm A is planning to acquire Firm

Q22: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents