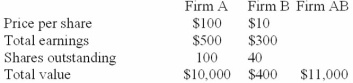

The following data on a merger is given:  Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. What will earnings per share be for Firm A after the merger assuming that cash is used in the acquisition?

Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. What will earnings per share be for Firm A after the merger assuming that cash is used in the acquisition?

A) $6

B) $7

C) $8

D) $5

Correct Answer:

Verified

Q3: Firm A has a value of $100

Q4: Many mergers that appear to make economic

Q5: The following reasons are good motives for

Q6: The following are good reasons for mergers:

I.

Q7: Tele Atlas acquisition of Tom Tom is

Q9: The BP and Amoco merger is an

Q10: The following are dubious reasons for mergers:

I.

Q11: Bank of America and Merrill Lynch merger

Q12: The merger of Pfizer and Wyeth is

Q13: Companies A and B are valued as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents