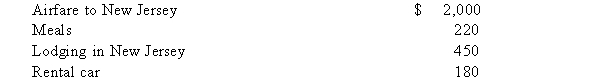

(described below) . What amount can Shelley deduct as an employee business expense (before considering any miscellaneous itemized deduction limitations) ?

A) $2,740

B) $1,850 if Shelley's AGI is $50,000

C) $2,850

D) All of the expenses are deductible if Shelley is reimbursed under an accountable plan.

E) None of the expenses are deductible - only employers can deduct travel expenses.

Correct Answer:

Verified

Q40: Paris operates a talent agency as a

Q41: John is a self-employed computer consultant who

Q42: When does the all-events test under the

Q43: Which of the following is a true

Q44: Which of the following cannot be selected

Q46: Which of the following is a true

Q47: Which of the following expenses are completely

Q48: George operates a business that generated adjusted

Q49: Ronald is a cash method taxpayer who

Q50: Qualified production activities income is defined as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents