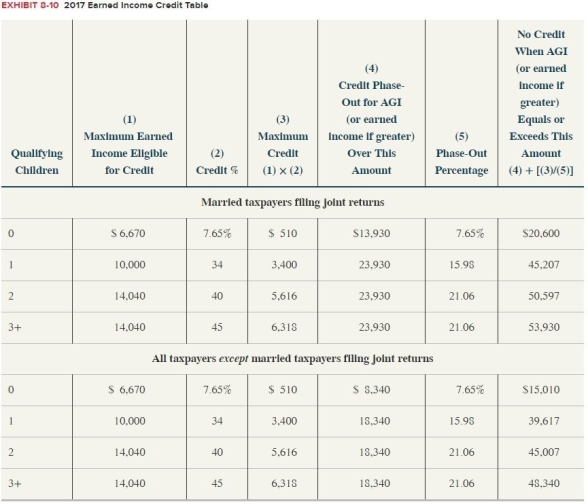

Sam is 30 years old. In 2017, he reported an AGI of $12,000, all from his job as a server at the local café. He is single and has no dependents. What amount of earned income credit may he claim in2017? Use Exhibit 8-10.

Correct Answer:

Verified

Answe...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q141: Wolfina's twins,Romulus and Remus,finished their first year

Q142: Clarissa's gross tax liability for 2017 is

Q144: Atlas earned $17,300 from his sole proprietorship

Q147: Demeter is a single taxpayer.Her AGI in

Q148: Akiko and Hitachi (married filing jointly for

Q152: Assume Georgianne underpaid her estimated tax liability

Q152: In 2017,Shawn's AGI is $170,000.He earned the

Q154: Johann had a gross tax liability of

Q157: Keith and Nicole are married filing joint

Q177: Jack paid $5,000 in daycare expenses for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents