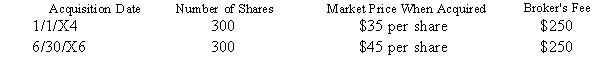

On December 1, 20X7, George Jimenez needed a little extra cash for the upcoming holiday season, and sold250 shares of Microsoft stock for $50 per share less a broker's fee of $200 for the entire sale transaction. Prior to the sale, George held the following blocks of Microsoft stock (associated broker's fee paid at the time of purchase):  If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: Compare and contrast how interest income is

Q46: Bob Brain files a single tax return

Q47: Generally, which of the following does not

Q49: Doug and Sue Click file a joint

Q50: Unused investment interest expense:

A) expires after the

Q52: Assume that Joe has a marginal tax

Q53: Brandon and Jane Forte file a joint

Q54: The rental real estate exception favors:

A) middle

Q55: Michelle is an active participant in the

Q56: Alain Mire files a single tax return

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents