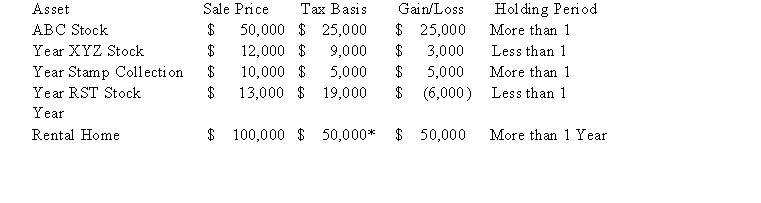

Henry, a single taxpayer with a marginal tax rate of 35 percent, sold the following assets during the year:  *$25,000 of the gain is a 25 percent gain. The remaining gain is 0/15/20 percent gain. What tax rate(s) will apply to Henry's capital gains or losses?

*$25,000 of the gain is a 25 percent gain. The remaining gain is 0/15/20 percent gain. What tax rate(s) will apply to Henry's capital gains or losses?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: The Crane family recognized the following types

Q64: Kerri,a single taxpayer who itemizes deductions on

Q67: On January 1, 20X8, Jill contributed $18,000

Q69: What is the tax treatment for qualified

Q70: How can electing to include long-term capital

Q71: How are individual taxpayers' investment expenses and

Q71: Judy, a single individual, reports the following

Q72: Sarantuya,a college student,feels that now is a

Q75: Dan and Sue Hill file a joint

Q86: Roy, a resident of Michigan, owns 25

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents