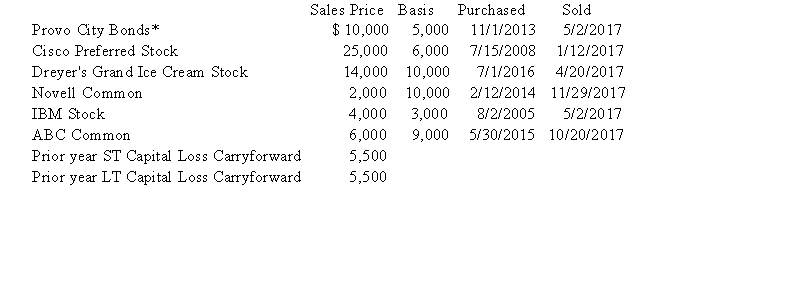

Scott Bean is a computer programmer and incurred the following transactions last year.  *Purchased when originally issued by Provo CityWhat is the Net Short-Term Capital Gain/Loss reported on the 2017 Schedule D? What is the Net Long-TermCapital Gain/Loss reported on the 2017 Schedule D? What amount of capital gain is subject to the preferential capital gains rate?

*Purchased when originally issued by Provo CityWhat is the Net Short-Term Capital Gain/Loss reported on the 2017 Schedule D? What is the Net Long-TermCapital Gain/Loss reported on the 2017 Schedule D? What amount of capital gain is subject to the preferential capital gains rate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q53: On January 1,20X1,Fred purchased a corporate bond

Q56: Alain Mire files a single tax return

Q57: Which taxpayer would not be considered a

Q59: Investment expenses treated as miscellaneous itemized deductions

Q67: Mr. and Mrs. Smith purchased 100 shares

Q69: What is the tax treatment for qualified

Q70: How can electing to include long-term capital

Q76: What requirements must be satisfied before an

Q86: Roy, a resident of Michigan, owns 25

Q87: Describe the three main loss limitations that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents