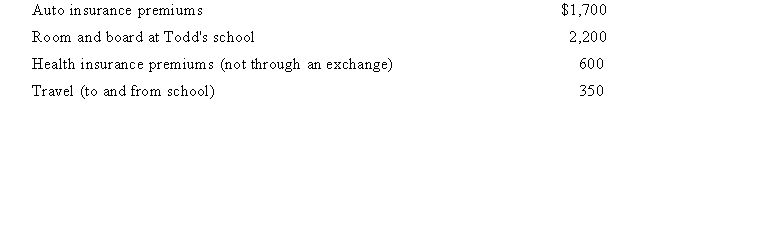

Ned is a head of household with a dependent son, Todd, who is a full-time student. This yea5r7N) ed made the following expenditures related to Todd's support:  What amount can Ned include in his itemized deductions?

What amount can Ned include in his itemized deductions?

A) $2,050 included in Ned's miscellaneous itemized deductions.

B) $950 included in Ned's miscellaneous itemized deductions.

C) $600 included in Ned's medical expenses.

D) $1,700 included in Ned's miscellaneous itemized deductions.

E) None of the choices are correct.

Correct Answer:

Verified

Q47: This year Amanda paid $749 in Federal

Q48: Which of the following is a true

Q49: Grace is a single medical student at

Q50: Max paid $5,000 of tuition for him

Q51: Bruce is employed as an executive and

Q53: Hector is a married self-employed taxpayer, and

Q54: This fall, Josh paid $5,000 for his

Q55: Which of the following costs are deductible

Q56: Casey currently commutes 35 miles to work

Q57: Lewis is an unmarried law student at

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents