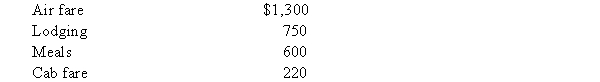

Fred's employer dispatched him on a business trip from the Dallas headquarters to New York78t) his year. During the trip Fred incurred the following unreimbursed expenses:  What is the amount of Fred's deduction before the application of any AGI limitations?

What is the amount of Fred's deduction before the application of any AGI limitations?

A) $2,870.

B) $2,050.

C) $2,570.

D) $1,300.

E) $0 - the expenses cannot be deducted unless Fred is reimbursed.

Correct Answer:

Verified

Q59: Opal fell on the ice and injured

Q60: This year Norma paid $1,200 of real

Q61: Simone donated a landscape painting (tangible capital

Q62: Jim was in an auto accident this

Q63: Which of the following is a true

Q65: Margaret Lindley paid $15,000 of interest on

Q66: Which of the following is a true

Q67: Which of the following itemized deductions is

Q68: Grace is employed as the manager of

Q69: Which of the following is a true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents