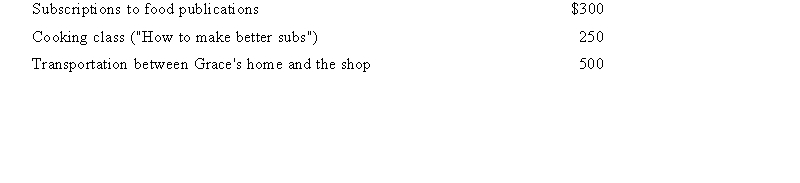

Grace is employed as the manager of a sandwich shop. This year she earned a salary of $45,0810) 0 and incurred the following expenses associated with her employment:  What amount of miscellaneous itemized deductions can Grace claim on Schedule A if these are her only miscellaneous itemized deductions?

What amount of miscellaneous itemized deductions can Grace claim on Schedule A if these are her only miscellaneous itemized deductions?

A) $200 if Grace was reimbursed $50 for her cooking class.

B) $550.

C) $150.

D) $1,050.

E) None of the choices are correct.

Correct Answer:

Verified

Q63: Which of the following is a true

Q64: Fred's employer dispatched him on a business

Q65: Margaret Lindley paid $15,000 of interest on

Q66: Which of the following is a true

Q67: Which of the following itemized deductions is

Q69: Which of the following is a true

Q70: Which of the following is a true

Q71: Glenn is an accountant who races stock

Q72: Larry recorded the following donations this year:$500

Q73: Which of the following is a miscellaneous

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents