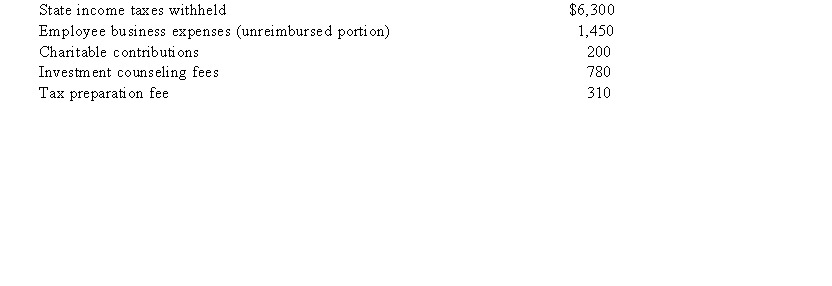

Toshiomi works as a sales representative and travels extensively for his employer's business. This yearToshiomi was paid $75,000 in salary and made the following expenditures:  Toshiomi also made a number of trips to Las Vegas for gambling. This year Toshiomi won $12,000 in a poker tournament and this amount was almost enough to offset his other gambling losses ($13,420). CalculateToshiomi's taxable income if he files single with one personal exemption.

Toshiomi also made a number of trips to Las Vegas for gambling. This year Toshiomi won $12,000 in a poker tournament and this amount was almost enough to offset his other gambling losses ($13,420). CalculateToshiomi's taxable income if he files single with one personal exemption.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q97: Clark is a registered nurse and full

Q99: Shelby is working as a paralegal while

Q100: Q101: Misti purchased a residence this year. Misti Q102: Don's personal auto was damaged in a Q103: Bryan is 62 years old and lives Q105: Rochelle,a single taxpayer (age 47),has an AGI Q106: Jon and Holly are married and live Q107: Justin and Georgia file married jointly with Q110: This year Kelly bought a new auto![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents