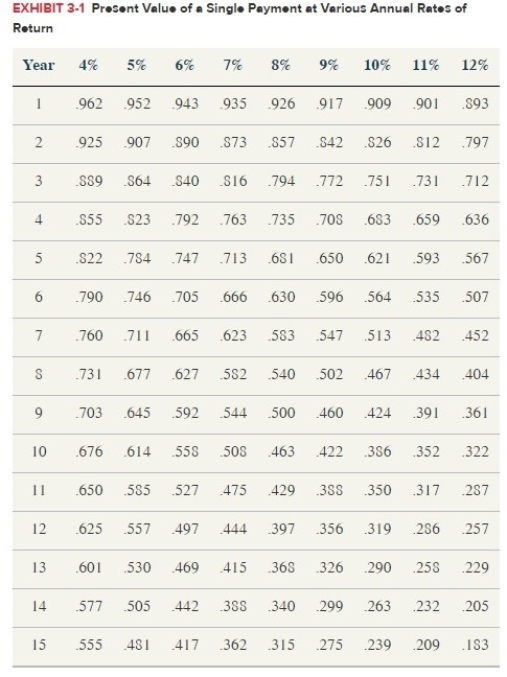

Assuming an after-tax rate of return of 10%, John should prefer to pay an expense of $85 today instead of an expense of $100 in one year. Use Exhibit 3.1.

Correct Answer:

Verified

Q2: The time value of money suggests that

Q3: In general, tax planners prefer to defer

Q4: When considering cash outflows, higher present values

Q8: The timing strategy is based on the

Q15: The timing strategy becomes more attractive as

Q18: Tax savings generated from deductions are considered

Q25: Investors must consider complicit taxes as well

Q36: Paying dividends to shareholders is one effective

Q37: The business purpose, step-transaction, and substance-over-form doctrines

Q38: The downside of tax avoidance includes the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents