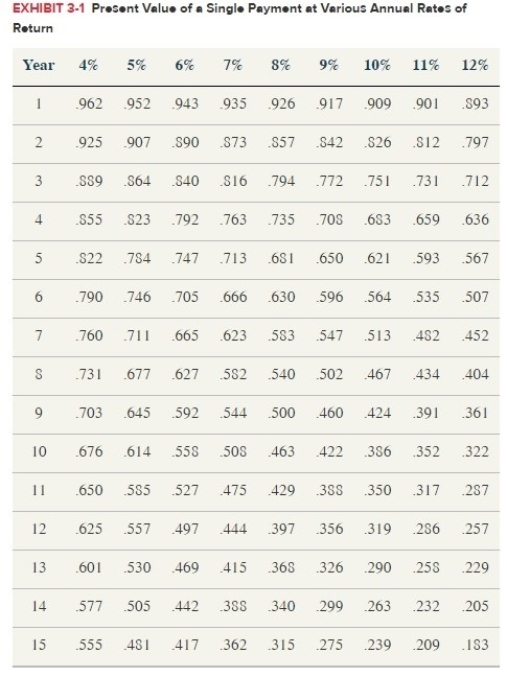

Based only on the information provided for each scenario, determine whether Eddy or Scott will benefit more from using the timing strategy and why there will be a benefit to that person. Use Exhibit 3.1.  a. Eddy has a 40% tax rate. Scott has a 30% tax rate.b. Eddy and Scott each have a 40% tax rate. Eddy has $10,000 of income that could be deferred; Scott has$20,000 of income that could be shifted.c. Eddy and Scott each have a 40% tax rate and $20,000 of income that could be deferred. Eddy's after-tax rate of return is 8%. Scott's after-tax rate of return is 10%.d. Eddy and Scott each have a 40% tax rate, $20,000 of income that could be deferred, and an after-tax rate of return of 10%. Eddy can defer income up to 3 years. Scott can defer income up to 2 years.

a. Eddy has a 40% tax rate. Scott has a 30% tax rate.b. Eddy and Scott each have a 40% tax rate. Eddy has $10,000 of income that could be deferred; Scott has$20,000 of income that could be shifted.c. Eddy and Scott each have a 40% tax rate and $20,000 of income that could be deferred. Eddy's after-tax rate of return is 8%. Scott's after-tax rate of return is 10%.d. Eddy and Scott each have a 40% tax rate, $20,000 of income that could be deferred, and an after-tax rate of return of 10%. Eddy can defer income up to 3 years. Scott can defer income up to 2 years.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q87: Paying "fabricated" expenses in high tax rate

Q88: Sal, a calendar year taxpayer, uses the

Q93: Joe Harry, a cash basis taxpayer, owes

Q96: Rodney, a cash basis taxpayer, owes $40,000

Q102: There are two basic timing-related tax rate

Q105: Lucinda is contemplating a long-range planning strategy

Q105: Troy is not a very astute investor.He

Q109: An astute tax student once summarized that

Q111: Lucky owns a maid service that cleans

Q115: Jared, a tax novice, has recently learned

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents