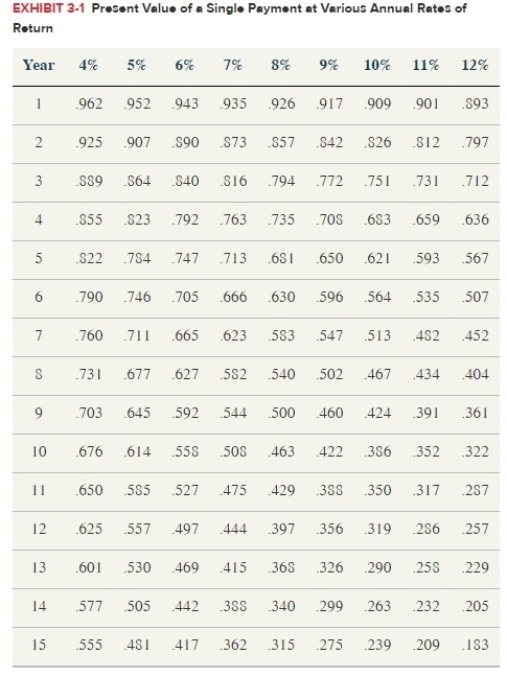

Based only on the information provided for each scenario, determine whether Kristi or Cindy will benefit more from using the timing strategy and why there will be a benefit to that person. Use Exhibit 3.1.  a. Kristi has a 40% tax rate and can defer $20,000 of income. Cindy has a 30% tax rate and can defer $30,000 of income.b. Kristy has a 30% tax rate, a 10% after-tax rate of return, and can defer $25,000 of income for three years. Cindy has a 40% tax rate, an 8% after-tax rate of return, and can defer $20,000 of income for four years.

a. Kristi has a 40% tax rate and can defer $20,000 of income. Cindy has a 30% tax rate and can defer $30,000 of income.b. Kristy has a 30% tax rate, a 10% after-tax rate of return, and can defer $25,000 of income for three years. Cindy has a 40% tax rate, an 8% after-tax rate of return, and can defer $20,000 of income for four years.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q96: Rodney, a cash basis taxpayer, owes $40,000

Q101: Bono owns and operates a sole proprietorship

Q103: Maurice is currently considering investing in a

Q104: Rob is currently considering investing in municipal

Q104: Bobby and Whitney are husband and wife

Q105: Troy is not a very astute investor.He

Q105: Lucinda is contemplating a long-range planning strategy

Q106: Boeing is considering opening a plant in

Q116: Compare and contrast the constructive receipt doctrine

Q119: Explain why $1 today is not equal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents