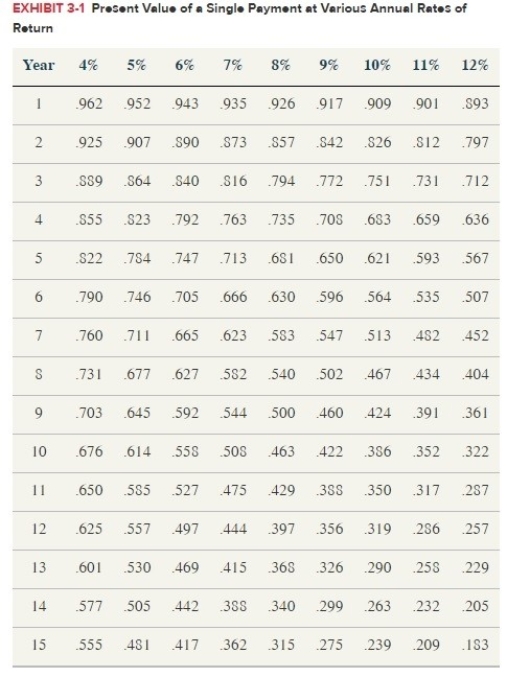

Antonella works for a company that pays a year-end bonus in December of each year. Assume that Antonella expects to receive a $20,000 bonus in December this year, her tax rate is 30%, and her after-tax rate of return is 8%. If Antonella's employer paid her bonus on January 1 of next yearinstead of in December, how much would this action save Antonella in today's tax dollars? If Antonella's tax rate increased to 32% next year, would receiving the bonus in January still be advantageous? Use Exhibit 3.1.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q76: Assume that Lavonia's marginal tax rate is

Q77: A taxpayer earning income in "cash" and

Q78: Assume that Jose is indifferent between investing

Q79: Which of the following is more likely

Q80: The income shifting and timing strategies are

Q84: Danny argues that tax accountants suffer from

Q86: O'Reilly is a masterful lottery player. The

Q97: Luther was very excited to hear about

Q113: Richard recently received $10,000 of compensation for

Q120: David, an attorney and cash-basis taxpayer, is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents