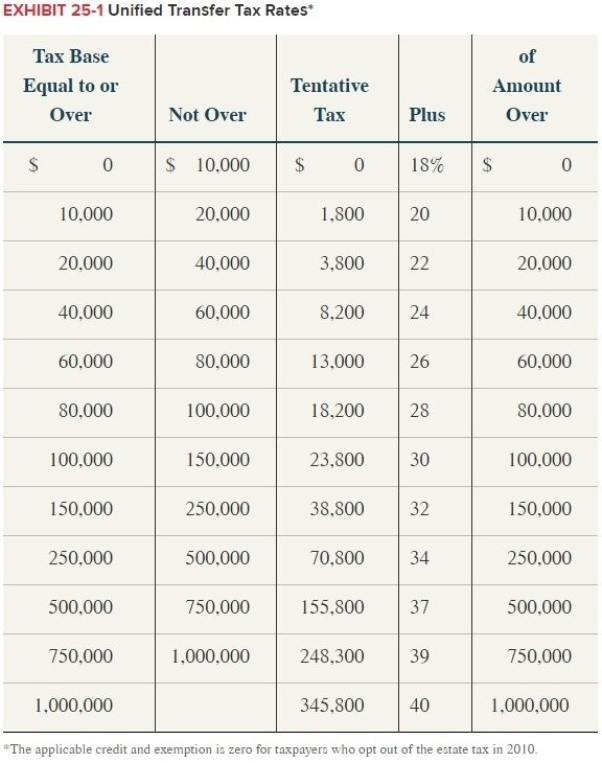

Eric has $5 million of property that he wants to leave to his four children. He is considering making a current gift of the property (rather than leaving the property to pass through his will). Eric has made many prior taxable gifts and additional taxable transfers will be subject to the highest transfer tax rate. Determine how much estate tax Eric will save if he gifts the property now and survives at least three years, during which time the property appreciates to $5.5 million? Ignore the time value of money in your calculation. (Use Exhibit 25-1)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: For the holidays, Samuel gave a necklace

Q108: James and Jasmine live in a community-property

Q114: This year Maria transferred $600,000 to an

Q119: Ryan placed $280,000 in trust with income

Q121: Last year Diego transferred a life insurance

Q122: Gabriel had a taxable estate of $6

Q131: Joshua and David purchased real property for

Q135: Angel and Abigail are married and live

Q138: Ashley owns a whole-life insurance policy worth

Q144: Isaac is married and Isaac and his

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents