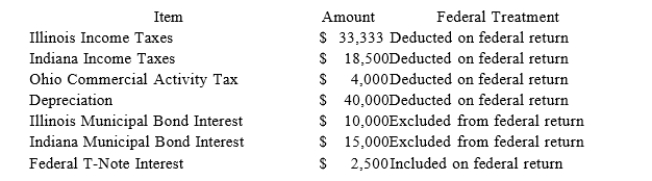

Hoosier Incorporated is an Indiana corporation. It properly included, deducted, or excluded t8h1e) following items on its federal tax return in the current year:  State depreciation expense was $50,000. Hoosier's Federal Taxable Income was $150,300. Calculate Hoosier's Illinois state tax base.

State depreciation expense was $50,000. Hoosier's Federal Taxable Income was $150,300. Calculate Hoosier's Illinois state tax base.

A) $173,800.

B) $204,633.

C) $171,300.

D) $207,133.

Correct Answer:

Verified

Q87: Super Sadie,Incorporated manufactures sandals and distributes them

Q90: Mighty Manny,Incorporated manufactures and services deli machinery

Q92: What was the Supreme Court's holding in

Q94: Which of the following is an income

Q95: Lefty provides demolition services in several southern

Q97: What is Carolina's Hats North and South

Q98: Handsome Rob provides transportation services in several

Q98: List the steps necessary to determine an

Q100: Mighty Manny, Incorporated manufactures and services deli

Q113: Gordon operates the Tennis Pro Shop in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents