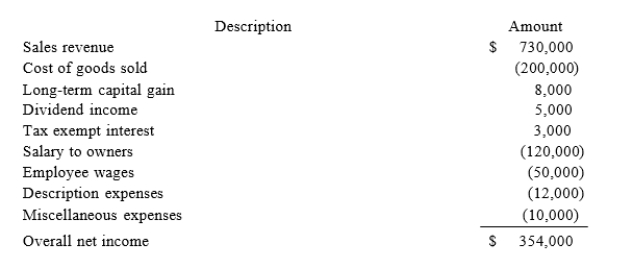

XYZ Corporation (an S corporation) is owned by Jane and Rebecca who are each 50% shareholders. At the beginning of the year, Jane's basis in her XYZ stock was $40,000. XYZ reported the following tax information for 2017.  Required:a. What amount of ordinary business income is allocated to Jane?b. What is the amount and character of separately stated items allocated to Jane?c. What is Jane's basis in her XYZ corp. stock at the end of the year?

Required:a. What amount of ordinary business income is allocated to Jane?b. What is the amount and character of separately stated items allocated to Jane?c. What is Jane's basis in her XYZ corp. stock at the end of the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: ABC Corp. elected to be taxed as

Q107: Maria resides in San Antonio, Texas. She

Q108: Parker is a 100% shareholder of Johnson

Q109: Which of the following statements is correct

Q110: Jackson is the sole owner of JJJ

Q112: Suppose SPA Corp. was formed by Sara

Q113: Maria, a resident of Mexico City, Mexico,

Q114: CB Corporation was formed as a calendar-year

Q114: Jason is one of 100 shareholders in

Q115: AIRE was initially formed as an S

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents