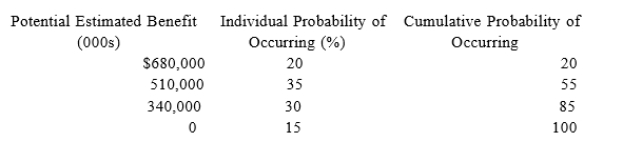

Morgan Corporation determined that $2,000,000 of its domestic production activities deduction on its current year tax return was uncertain, but that it was more likely than not to be sustained on audit. Management made the following assessment of the company's potential tax benefit from the deduction and its probability ofoccurring.  Under ASC 740, what amount of the tax benefit related to the domestic production activities deduction canMorgan recognize in calculating its income tax provision in the current year?

Under ASC 740, what amount of the tax benefit related to the domestic production activities deduction canMorgan recognize in calculating its income tax provision in the current year?

Correct Answer:

Verified

The amount ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Yellow Rose Corporation reported pretax book income

Q84: For 2017, Manchester Corporation recorded the following

Q85: In 2017, Moody Corporation recorded the following

Q85: Lafayette,Inc.completed its first year of operations with

Q86: Acai Corporation determined that $5,000,000 of its

Q88: Stone Corporation reported pretax book income of

Q89: Milton Corporation reported pretax book income of

Q91: Farm Corporation reported pretax book loss of

Q92: Price Corporation reported pretax book income of

Q94: DeWitt Corporation reported pretax book income of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents