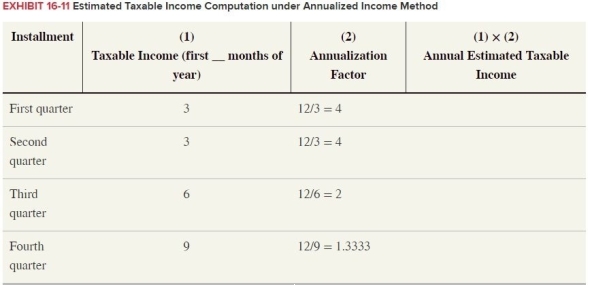

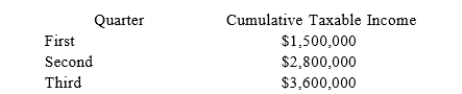

In the current year, Auto Rent Corporation reported the following taxable income at the end of its first, second, and third quarters: (Use Exhibit 16-11)

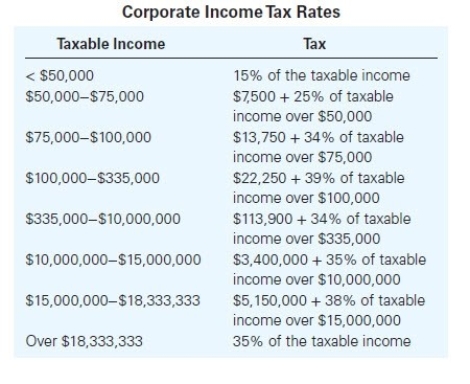

What amount of estimated tax payments would Auto Rent pay each quarter in order to avoid estimated tax penalties under the annualized income method of computing estimated tax payments? (Use Corporate Tax Rate Schedule.)

What amount of estimated tax payments would Auto Rent pay each quarter in order to avoid estimated tax penalties under the annualized income method of computing estimated tax payments? (Use Corporate Tax Rate Schedule.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q123: IndusTree Inc.received $1,800,000 from the sale of

Q126: On January 1,2016,GrowCo issued 50,000 nonqualified stock

Q127: TerraWise Inc. reported the following information for

Q127: Pure Action Cycles Inc.,a bicycle manufacturer,has a

Q128: VitalJuice Corporation reports the following schedule of

Q128: On January 1,2005 [before the adoption of

Q129: For 2017, SRH's taxable income is $35,000

Q131: ValuCo gives you the following information:

Q137: AB Inc.received a dividend from CD Corporation

Q140: In 2017,LuxAir Inc.(LA)has book income of $160,000.Included

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents