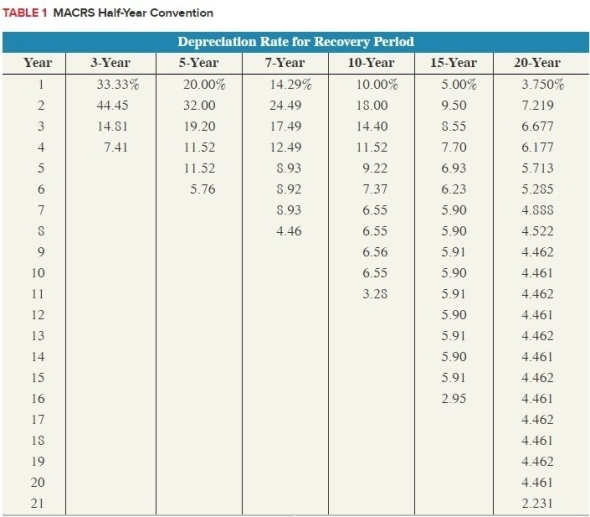

Kristine sold two assets on March 20th of the current year. The first was machinery with an original basis of $51,000, currently in the fourth year of depreciation, and under the half-year convention. The second was furniture with an original basis of $16,000 placed in service during the fourth quarter, currently in the third year of depreciation, and under the mid-quarter convention. What is Kristine's depreciation expense for the current year if the depreciation recovery period is 7-years? (Use MACRS Table 1 and Table 2) EXHIBIT 10-6 (Round final answer to the nearest whole number)

Correct Answer:

Verified

The depreciation on tho...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q67: Bonnie Jo used two assets during the

Q68: Daschle LLC completed some research and development

Q69: Yasmin purchased two assets during the current

Q70: Roth, LLC purchased only one asset during

Q71: During April of the current year, Ronen

Q73: Flax, LLC purchased only one asset this

Q74: Santa Fe purchased the rights to extract

Q75: Teddy purchased only one asset during the

Q76: Amit purchased two assets during the current

Q77: Geithner LLC patented a process it developed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents