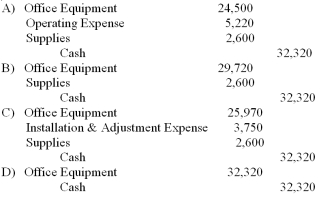

A company purchased office equipment for $24,500 and paid $1,470 in sales tax, $550 for installation, $3,200 for a needed adjustment to the equipment, and $2,600 for supplies that will be used for periodic routine

Maintenance. What is the journal entry to record this purchase?

A) Option: A

B) Option: B

C) Option: C

D) Option: D

Correct Answer:

Verified

Q51: A company acquired property that included land,building

Q101: Freight costs incurred when a long-lived asset

Q102: Extraordinary repairs

A)are revenue expenditures.

B)extend an asset's life

Q104: Which of the following is true about

Q106: Company A uses an accelerated depreciation method

Q110: When originally purchased,a vehicle had an estimated

Q111: When estimated useful life of an asset

Q113: Furniture with a $3,000 sticker price is

Q194: Goodwill:

A)is not amortized,but is tested annually for

Q250: Once the depreciation expense for a long-lived

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents