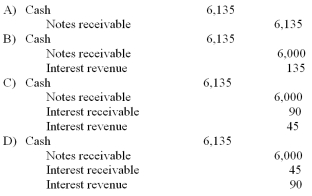

On December 1, 2010, a company accepted a $6,000, 9%, 3-month note from a customer in payment of his overdue account. The company prepares year-end financial statements on December 31. What entry should the company make on March 1, 2011, when the note and interest are paid?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q105: What is the amount due on the

Q109: The journal entry to record the write-off

Q110: What is the receivables turnover ratio for

Q111: The unadjusted trial balance at the end

Q112: What is the days to collect for

Q114: What is the total amount of interest

Q115: The required entry(ies) on May 29 to

Q116: Assuming the entry to record bad debt

Q117: On December 1, 2010, a company loaned

Q118: If the company changes its credit granting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents