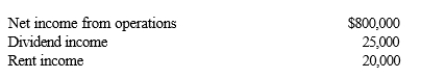

Catfish, Inc., a closely held corporation which is not a PSC, owns a 45% interest in Trout Partnership, which is classified as a passive activity.Trout's taxable loss for the current year is $250,000.During the year, Catfish receives a $60,000 cash distribution from Trout.Other relevant data for Catfish are as follows.  How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

A) $0

B) $20,000

C) $45,000

D) $112,500

Correct Answer:

Verified

Q41: Tuan and Ella are going to establish

Q44: Match the following statements.

-Sale of the individual

Q51: Thu and Tuan each own one-half of

Q52: Arnold purchases a building for $750,000 which

Q53: Match the following attributes with the different

Q54: Alice contributes equipment fair market value of

Q56: Albert's sole proprietorship owns the following assets.

Q59: Khalid contributes land fair market value of

Q69: Malcomb and Sandra (shareholders) each loan Crow

Q171: Match each of the following statements with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents