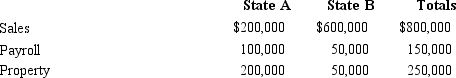

Boot Corporation is subject to income tax in States A and B.Boot's operations generated $200,000 of apportionable income, and its sales and payroll activity and average property owned in each of the states is as follows.  How much more less) of Boot's income is subject to A income tax if, instead of using an equally-weighted three- factor apportionment formula, A uses a formula with a double-weighted sales factor?

How much more less) of Boot's income is subject to A income tax if, instead of using an equally-weighted three- factor apportionment formula, A uses a formula with a double-weighted sales factor?

A) $50,000)

B) $50,000

C) $16,100

D) $16,100)

Correct Answer:

Verified

Q44: The model law relating to the assignment

Q62: The throwback rule requires that:

A) Sales of

Q64: General Corporation is taxable in a number

Q70: General Corporation is taxable in a number

Q76: In applying the typical apportionment formula:

A) The

Q81: Chipper Corporation realized $1,000,000 taxable income from

Q82: In the broadest application of the unitary

Q94: Hendricks Corporation sells widgets in two states.

Q101: Parent and Junior form a unitary group

Q119: In conducting multistate tax planning, the taxpayer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents