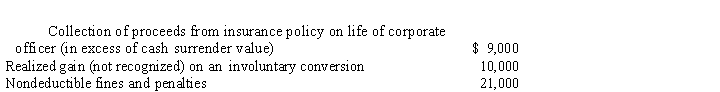

Kite Corporation, a calendar year taxpayer, has taxable income of $360,000 for 2019.Among its transactions for the year are the following:  Disregarding any provision for Federal income taxes, determine Kite Corporation's current E & P for 2019.

Disregarding any provision for Federal income taxes, determine Kite Corporation's current E & P for 2019.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Tanya is in the 32% tax bracket.She

Q127: Matching

Using the legend provided, classify each statement

Q133: Using the legend provided, classify each statement

Q142: At the beginning of the current year,

Q145: Scarlet Corporation is an accrual basis, calendar

Q151: Albatross Corporation acquired land for investment purposes

Q152: Maria owns 75% and Christopher owns 25%

Q158: Thrush, Inc., is a calendar year, accrual

Q160: On January 1, Tulip Corporation (a calendar

Q173: Timothy owns 100% of Forsythia Corporation's stock.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents