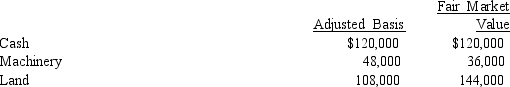

Donghai transferred the following assets to Starling Corporation.  In exchange, Donghai received 50% of Starling Corporation's only class of stock outstanding.The stock has no established value.However, all parties believe that the value of the stock Donghai received is the equivalent of the value of the assets she transferred.The only other shareholder, Rick, formed Starling Corporation five years ago.

In exchange, Donghai received 50% of Starling Corporation's only class of stock outstanding.The stock has no established value.However, all parties believe that the value of the stock Donghai received is the equivalent of the value of the assets she transferred.The only other shareholder, Rick, formed Starling Corporation five years ago.

A) Donghai has no gain or loss on the transfer.

B) Starling Corporation has a basis of $48,000 in the machinery and $108,000 in the land.

C) Starling Corporation has a basis of $36,000 in the machinery and $144,000 in the land.

D) Donghai has a basis of $276,000 in the stock of Starling Corporation.

E) None of the above.

Correct Answer:

Verified

Q55: Elk, a C corporation, has $370,000 operating

Q63: Dawn, a sole proprietor, was engaged in

Q63: In the current year, Red Corporation (a

Q68: Earl and Mary form Crow Corporation. Earl

Q71: Orange Corporation, a calendar year C corporation,

Q74: During the current year, Sparrow Corporation, a

Q76: Copper Corporation, a calendar year C corporation,

Q79: Adam transfers cash of $300,000 and land

Q99: Wren Corporation (a minority shareholder in Lark

Q100: Eve transfers property (basis of $120,000 and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents