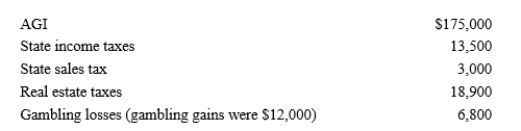

Paul, a calendar year single taxpayer, has the following information for 2018:  Paul’s allowable itemized deductions for 2018 are:

Paul’s allowable itemized deductions for 2018 are:

A) $10,000.

B) $16,800.

C) $39,200.

D) $42,200.

E) None of the above.

Correct Answer:

Verified

Q49: This year, Carol, a single taxpayer, purchased

Q50: Roger is considering making a $6,000 investment

Q58: Ahmad is considering making a $10,000 investment

Q63: Byron owned stock in Blossom Corporation that

Q70: Your friend Scotty informs you that he

Q72: In the current year, Jerry pays $8,000

Q110: During the current year, Ralph made the

Q111: Hugh, a self-employed individual, paid the following

Q112: In 2017, Juan and Juanita incur $9,800

Q116: Hannah makes the following charitable donations in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents