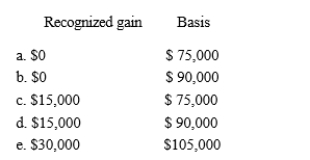

Nat is a salesman for a real estate developer.His employer permits him to purchase a lot for $75,000.The employer's adjusted basis for the lot is $45,000, and its normal selling price is $90,000. What is Nat's recognized gain and his basis for the lot?

Correct Answer:

Verified

Q3: An exchange of two items of personal

Q25: A taxpayer who sells his or her

Q34: The maximum amount of the § 121

Q73: If a taxpayer exchanges like-kind property under

Q84: Wyatt sells his principal residence in December

Q87: To qualify for the § 121 exclusion,

Q94: Gil's office building (basis of $225,000 and

Q106: Katie sells her personal use automobile for

Q117: Joyce's office building was destroyed in a

Q119: On February 1, Karin purchases real estate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents