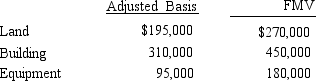

Mona purchased a business from Judah for $1,000,000.Judah's records and an appraiser provided her with the following information regarding the assets purchased:  What is Mona's adjusted basis for the land, building, and equipment?

What is Mona's adjusted basis for the land, building, and equipment?

A) Land $270,000, building $450,000, equipment $180,000.

B) Land $195,000, building $575,000, equipment $230,000.

C) Land $195,000, building $310,000, equipment $95,000.

D) Land $270,000, building $521,429, equipment $208,571.

E) None of the above.

Correct Answer:

Verified

Q124: In addition to other gifts, Megan made

Q125: In 2014, Harold purchased a classic car

Q126: Noelle received dining room furniture as a

Q132: The holding period of property acquired by

Q134: Kevin purchased 5,000 shares of Purple Corporation

Q139: Which of the following is correct?

A) The

Q140: Over the past 20 years, Alfred has

Q147: Arthur owns a tract of undeveloped land

Q150: Kelly inherits land which had a basis

Q153: Andrew acquires 2,000 shares of Eagle Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents