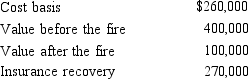

John had adjusted gross income of $60,000 in 2018.During the year his personal use summer home was damaged by a fire.Pertinent data with respect to the home follows:  John had an accident with his personal use car.As a result of the accident, John was cited with reckless driving and willful negligence.Pertinent data with respect to the car follows:

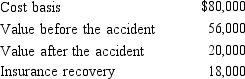

John had an accident with his personal use car.As a result of the accident, John was cited with reckless driving and willful negligence.Pertinent data with respect to the car follows: What is John's itemized casualty loss deduction?

What is John's itemized casualty loss deduction?

A) $0

B) $2,000

C) $17,000

D) $18,000

E) None of the above

Correct Answer:

Verified

Q41: Joyce, an architect, earns $100,000 from her

Q46: Jennifer gave her interest in a passive

Q46: Two years ago, Gina loaned Tom $50,000.

Q49: Three years ago, Sharon loaned her sister

Q50: Kathy, who qualifies as a real estate

Q50: Five years ago, Tom loaned his son

Q55: Gloria owns and works full-time at a

Q65: Which of the following events would produce

Q76: Jim had a car accident in 2018

Q77: Norm's car, which he uses 100% for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents