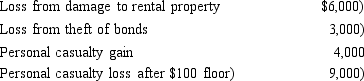

In 2018, Morley, a single taxpayer, had an AGI of $30,000 before considering the following items:  The personal casualties occurred in a Federally-declared disaster area.Determine the amount of Morley's itemized deduction from the losses.

The personal casualties occurred in a Federally-declared disaster area.Determine the amount of Morley's itemized deduction from the losses.

A) $0

B) $2,900

C) $5,120

D) $5,600

E) None of the above

Correct Answer:

Verified

Q42: Josh has investments in two passive activities.

Q43: Charles owns a business with two separate

Q44: Tara owns a shoe store and a

Q48: Carl, a physician, earns $200,000 from his

Q51: White Corporation, a closely held personal service

Q52: Nell sells a passive activity with an

Q55: In 2018, Wang invests $80,000 for a

Q61: In 2018, Cindy is married and files

Q63: Ahmad owns four activities. He participated for

Q65: Ned, a college professor, owns a separate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents