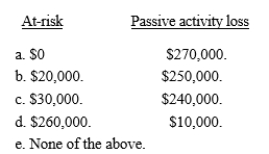

Several years ago, Joy acquired a passive activity.Until 2016, the activity was profitable.Joy's at-risk amount at the beginning of 2016 was $250,000.The activity produced losses of $100,000 in 2016, $80,000 in 2017, and $90,000 in 2018.During the same period, no passive activity income was recognized.How much is suspended under the at-risk rules and the passive activity loss rules at the beginning of 2019?

Correct Answer:

Verified

Q86: Melinda earns wages of $80,000, income from

Q88: Lew owns five activities, and he elects

Q89: Susan has the following items for 2018:

?

Q95: Faye dies owning an interest in a

Q99: George, an ophthalmologist, owns a separate business

Q101: Purple Corporation, a personal service corporation, earns

Q112: In 2018, Emily invests $120,000 in a

Q117: Sarah purchased for $100,000 a 10% interest

Q119: In 2017, Kelly earns a salary of

Q157: Tonya had the following items for last

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents