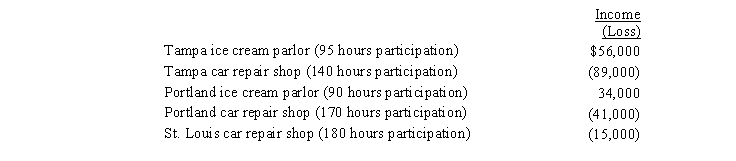

Lloyd, a life insurance salesman, earns a $400,000 salary in the current year.As he works only 30 hours per week in this job, he has time to participate in several other businesses.He owns an ice cream parlor and a car repair shop in Tampa.He also owns an ice cream parlor and a car repair shop in Portland and a car repair shop in St.Louis.A preliminary analysis on December 1 of the current year shows projected income and losses for the various businesses as follows:  Lloyd has full-time employees at each of the five businesses listed above.Review all possible groupings for Lloyd's activities.Which grouping method and other strategies should Lloyd consider that will provide the greatest tax advantage?

Lloyd has full-time employees at each of the five businesses listed above.Review all possible groupings for Lloyd's activities.Which grouping method and other strategies should Lloyd consider that will provide the greatest tax advantage?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q95: Match the term with the correct response.More

Q106: A taxpayer who sustains a casualty loss

Q107: Discuss the tax treatment of nonreimbursed losses

Q112: Orange Corporation, a closely held (nonpersonal service)

Q114: Vail owns interests in a beauty salon,

Q120: During the current year, Ryan performs personal

Q122: Last year, Wanda gave her daughter a

Q123: Identify how the passive activity loss rules

Q124: What special passive activity loss treatment is

Q125: Discuss the treatment given to suspended passive

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents