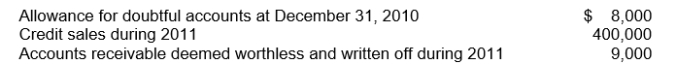

The following information is available for Sorensen Company:  As a result of a review and aging of accounts receivable in early January 2012, however, it has been determined that an allowance for doubtful accounts of $7,500 is needed at December 31, 2011.What amount should Sorensen record as bad debt expense for the year ended December 31, 2011?

As a result of a review and aging of accounts receivable in early January 2012, however, it has been determined that an allowance for doubtful accounts of $7,500 is needed at December 31, 2011.What amount should Sorensen record as bad debt expense for the year ended December 31, 2011?

A) $6,500

B) $7,500

C) $8,500

D) $15,500

Correct Answer:

Verified

Q28: Receivables are usually analyzed in terms of

A)their

Q29: Under the allowance method of recognizing uncollectible

Q30: Assuming Macoon uses the gross method, the

Q31: Use the following information for questions

On

Q32: Use the following information for questions

On

Q34: The amount of cash Inn received from

Q35: During the year, Bergh Company made an

Q36: The journal entries for a bank reconciliation

A)are

Q37: The advantage of relating a company's bad

Q38: The accounts receivable turnover ratio is calculated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents