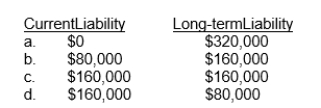

On January 1, 2010, Kapp Co.leased a building to Duerr Corp.for a ten-year term at an annual rental of $80,000.At inception of the lease, Kapp received $320,000 covering the first two years' rent of $160,000 and a security deposit of $160,000.This deposit will not be returned to Duerr upon expiration of the lease but will be applied to payment of rent for the last two years of the lease.What portion of the $320,000 should be shown as a current and long-term liability in Kapp's December 31, 2010 balance sheet?

Correct Answer:

Verified

Q40: Which of the following should be reported

Q42: Use the following information for questions

The

Q43: Use the following information for questions

The

Q46: Which of the following facts concerning depreciable

Q48: Use the following information for questions

The

Q56: In preparing a statement of cash flows,

Q103: In a statement of cash flows, payments

Q113: In a statement of cash flows, proceeds

Q117: In a statement of cash flows, interest

Q119: In a statement of cash flows, receipts

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents