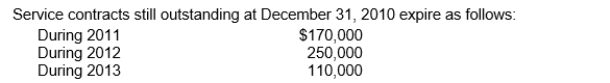

Denny Co.sells major household appliance service contracts for cash.The service contracts are for a one-year, two-year, or three-year period.Cash receipts from contracts are credited to Unearned Service Revenues.This account had a balance of $1,100,000 at December 31, 2010 before year-end adjustment.Service contract costs are charged as incurred to the Service Contract Expense account, which had a balance of $325,000 at December 31, 2010.  What amount should be reported as Unearned Service Revenues in Denny's December 31, 2010 balance sheet?

What amount should be reported as Unearned Service Revenues in Denny's December 31, 2010 balance sheet?

A) $775,000.

B) $530,000.

C) $250,000.

D) $325,000.

Correct Answer:

Verified

Q29: Which of the following is a nominal

Q38: Adjusting entries that should be reversed include

A)all

Q40: Scott Company purchased equipment on November 1,

Q41: Cole Co.pays all salaried employees on a

Q42: Perry Corporation loaned $78,000 to another corporation

Q44: At December 31, 2010, Patula Corporation has

Q45: Fischer Consulting paid $18,000 on December 1,

Q46: Use the following information for questions

Q47: On June 1, 2010, Mays Corp.loaned Farr

Q48: Use the following information for questions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents