Use the following information for questions

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

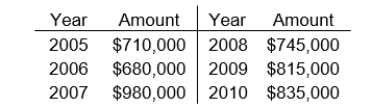

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

-During 2010, Kurz Company purchased the net assets of Sims Corporation for $635,000. On the date of the transaction, Sims had no long-term investments in marketable securities and had $200,000 of liabilities.The fair value of Sims' assets, when acquired were as follows:  How should the $365,000 difference between the fair value of the net assets acquired ($1 million) and the cost ($635,000) be accounted for by Kurz?

How should the $365,000 difference between the fair value of the net assets acquired ($1 million) and the cost ($635,000) be accounted for by Kurz?

A) The $365,000 difference should be credited to retained earnings.

B) The noncurrent assets should be recorded at $475,000.

C) The current assets should be recorded at $250,500 and the noncurrent assets should be recorded at $584,500.

D) It is not possible to answer this question until the components of the assets are

Correct Answer:

Verified

Q21: In January, 2005, Targa Corporation purchased a

Q22: The owners of Dallas' Electronics Store are

Q23: Huber Co.incurred research and development costs in

Q24: If a company constructs a laboratory building

Q25: Which of the following is an appropriate

Q27: Use the following information for questions

Jeremiah

Q28: Use the following information for questions

Jeremiah

Q29: Under private-entity GAAP, to determine if there

Q30: Under IFRS, to determine if there is

Q31: In 2010, Lawrence Corporation incurred development costs

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents