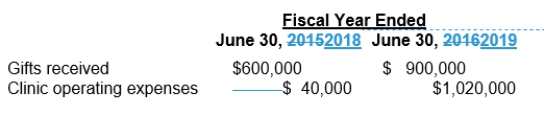

The Medical Arts Clinic, a well-established health care organization, received a $1,500,000 pledge in fiscal year 2018 that was restricted to cover operating expenses.The gift was received over two years; $600,000 in the first year and $900,000 in the second year.The following table reflects the funds received as well as the amounts spent on operating the clinic.  What should the clinic report as Net Assets Released from Restrictions on the statement of activities for the fiscal year ended June 30, 2019?

What should the clinic report as Net Assets Released from Restrictions on the statement of activities for the fiscal year ended June 30, 2019?

A) $900,000

B) $960,000

C) $1,020,000

D) $1,500,000

Correct Answer:

Verified

Q21: A hospital carried a 2-year malpractice insurance

Q23: The community hospital of Briarwood normally includes

Q24: A consortium of physicians agrees to provide

Q25: Sponsors of not-for-profit health care organizations generally

Q29: In the process of general purpose external

Q34: Hospital revenue usually includes which of the

Q35: The Gulf Coast bank is holding a

Q36: A hospital estimates that, based on past

Q37: Which of the following would normally be

Q40: In accounting for health care organizations, restricted

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents