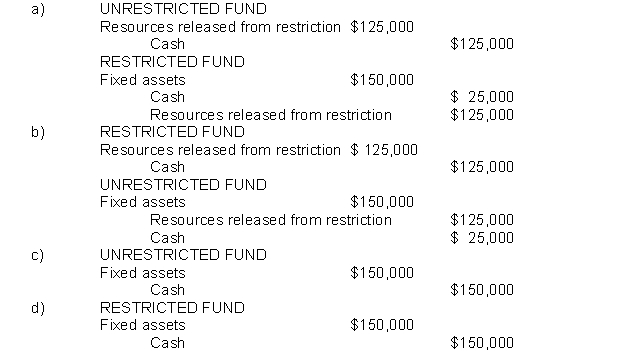

In a prior year, United Charities received a $125,000 gift to be used to acquire vans to provide transportation for physically challenged adults.During the current year, United acquired two vans at a cost of $75,000 each.The appropriate entry(ies)to record the acquisition is

Correct Answer:

Verified

Q26: St. Mary's Extended Care Center, a not-for-profit

Q27: United Charities’ annual fund-raising drive in 2016

Q31: The FASB requires that all not-for-profit organizations

Q32: During the annual fund-raising drive, the Cancer

Q33: Restricted gifts to not-for-profit organizations

A)Must always be

Q36: The account titled "Resources released from restriction"

Q37: Not-for-profit organizations report their cash flows in

Q38: Grace Church, a not-for-profit entity, operates a

Q58: During the year, a not-for-profit entity received

Q60: Which of the following entities should recognize

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents