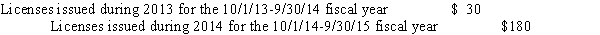

A city with a 12/31 fiscal year-end requires that restaurants buy a license, renewable yearly.Proceeds of the license fees are intended to pay the salaries of inspectors in the health department.Licenses are issued for a fiscal year from October 1 to September 30.During 2014, cash collections related to licenses were as follows  It is anticipated that during 2015 the amount collected on licenses for the 10/1/14-9/30/15 fiscal year will be $45.In September 2013 the amount collected related to 10/1/13-9/30/14 licenses was $144.What amount should be recognized as revenue in the fund financial statements for the fiscal year ended 12/31/14?

It is anticipated that during 2015 the amount collected on licenses for the 10/1/14-9/30/15 fiscal year will be $45.In September 2013 the amount collected related to 10/1/13-9/30/14 licenses was $144.What amount should be recognized as revenue in the fund financial statements for the fiscal year ended 12/31/14?

A) $180.

B) $183.

C) $210.

D) $225.

Correct Answer:

Verified

Q46: A local government began the year with

Q47: Governments should recognize revenue from donated capital

Q47: Under GAAP, investment income for governments must

Q49: A government is the recipient of a

Q50: A wealthy philanthropist donates three buildings to

Q52: At the beginning of its fiscal year,

Q55: During 2014, the city issued $300 in

Q55: Last year a city received notice of

Q59: Which of the following are not characterized

Q60: A government is the recipient of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents