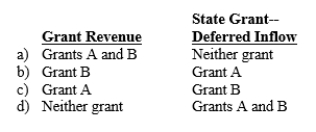

Paul City received payment of two grants from the state during its fiscal year ending September 30, 2013.Grant A can be used to cover any operating expenses incurred during fiscal 2014.Grant B can be used at any time to acquire equipment for the city's fire department.Should the city report these grants as grant revenues or deferred inflows in its government-wide financial statements for fiscal 2013?

Correct Answer:

Verified

Q47: Under GAAP, investment income for governments must

Q51: A city receives notice of a $150,000

Q52: At the beginning of its fiscal year,

Q53: Reimbursement-type grant revenues are recognized in the

Q55: Last year a city received notice of

Q55: During 2014, the city issued $300 in

Q56: A city is the recipient of a

Q57: Which of the following are derived tax

Q60: A government is the recipient of a

Q62: Paul City received payment of two grants

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents