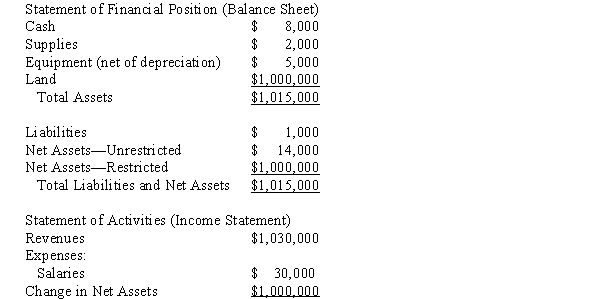

Save-the-Birds (STB), a not-for-profit entity dedicated to acquiring and preserving habitat for upland birds, prepares financial statements in accordance with generally accepted accounting principles.Currently, standards require that a not-for-profit entity report virtually all contributions as revenue in the year received.During the current year STB received a donation of several hundred acres of prime habitat for upland birds.STB will require several hundred thousand dollars in additional donations in order to make the land completely suitable for the birds.Before embarking on its fund-raising campaign STB prepares financial statements which are summarized as follows.  What difficulties, if any, will STB encounter in its new fund-raising drive? Knowing that the donation of the land accounted for $1,000,000 of the revenue reported by STB, do you think the financial statements present fairly the financial position and results of operations of this not-for-profit entity?

What difficulties, if any, will STB encounter in its new fund-raising drive? Knowing that the donation of the land accounted for $1,000,000 of the revenue reported by STB, do you think the financial statements present fairly the financial position and results of operations of this not-for-profit entity?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: A regulatory agency would use the external

Q37: Which of the following is NOT a

Q38: The basis of accounting selected by or

Q39: Which of the following entities was a

Q40: Under certain circumstances a government might use

Q44: Johnson City prepares its budget on the

Q46: What is the significance-for financial reporting purposes-of

Q46: Thorn County adopted a cash budget for

Q49: How does the FASB influence generally accepted

Q50: A not-for-profit entity raises funds to support

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents