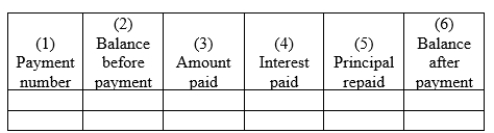

FIGURE 8.1 Basic Design of a Loan Repayment Schedule  Use the design shown in Figure 8.1 to construct a complete repayment schedule including the totaling of the Amount Paid, Interest Paid, and Principal Repaid columns for the following loan.

Use the design shown in Figure 8.1 to construct a complete repayment schedule including the totaling of the Amount Paid, Interest Paid, and Principal Repaid columns for the following loan.

On April 22, Tim borrowed $2900.00 from Keewatin Credit Union at 6.5% per annum calculated on the daily balance. He gave the Credit Union four cheques for $535.00 dated the 15th of each of the next four months starting May 15 and a cheque dated October 15 for the remaining balance to cover payment of interest and repayment of principal.

Correct Answer:

Verified

Q42: A promissory note has a face value

Q44: A promissory note has a face value

Q46: You bought a $100 000 91-day T-bill

Q48: Raymond borrowed $3900.00 from Airdrie Regional Savings.

Q50: You bought $150 000 in 364-day T-bills.

Q52: A promissory note has a face value

Q53: Calculate the maturity value of a 180-day

Q54: A non-interest bearing promissory note has a

Q57: A promissory note has a face value

Q60: A promissory note has a face value

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents