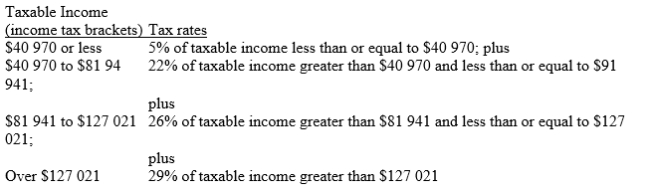

Use the 2010 federal income tax brackets and rates listed below to answer the following question.  a)Dana had a taxable income of $39 500 in 2010. How much federal income tax should she report? (assuming tax rates remain the same)

a)Dana had a taxable income of $39 500 in 2010. How much federal income tax should she report? (assuming tax rates remain the same)

b)Dana expects her taxable income to increase by 15% in 2011. How much federal tax would she expect to pay in 2011(assuming tax rates remain the same).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q111: A sales representative's orders for July were

Q121: Penny earned $26 000 in 2007. If

Q121: Calculate: Q124: Betty calculated her 2011 taxable income to Q128: Use the 2010 federal income tax brackets Q129: If one Canadian dollar is equivalent to Q130: Use the 2010 federal income tax brackets Q131: Cindi's annual incomes for 2002, 2006, and Q137: If one Canadian dollar is equivalent to Q139: What is the price of gasoline per![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents